Bankruptcy and Self-Employment in Arizona

Whether you’re working for somebody or you’re self-employed, you will have to meet certain bankruptcy filing requirements. Self-employed professionals and small business owners tend to have various questions about their eligibility and whether meeting the conditions for debt discharge is going to be easy.

Whether you’re working for somebody or you’re self-employed, you will have to meet certain bankruptcy filing requirements. Self-employed professionals and small business owners tend to have various questions about their eligibility and whether meeting the conditions for debt discharge is going to be easy.

Income Verification for Self-Employed Individuals in Arizona

The first and the most important consideration is income verification.

Such requirements exist under both Chapter 7 and Chapter 13 filing regulations. If you want to get a Chapter 7 bankruptcy, you will have to pass the Arizona means test that is based on the median income for the state. Individuals who cannot pass the test will need to do a Chapter 13 filing.

This may be a challenge for a self-employed individual because their income is going to vary from month to month. A mistake in the calculation will be easy to make and such a mistake will contribute to a dismissal by the bankruptcy court.

If you are considering a bankruptcy filing in the near future, you will have to start tracking your income immediately. This means keeping all of the documents that can be used to verify your income in court.

Bank statements, check stubs, tax returns and signed statements for payments you have received will need to be maintained and organized meticulously. The same applies to contracts you have with clients and the invoices you issue for each payment.

Keep in mind that if you are an independent contractor or a self-employed individual, you cannot experience wage garnishment in the traditional sense. You have to be employed by a company for your wage to be garnished due to debt accumulation. This, however, doesn’t mean that creditors cannot employ other means in order to collect the sums you owe them. Garnishment for property and other income streams can still occur. This way, a creditor will receive a one-time payment for the sums that you owe rather than receive a monthly amount each time you receive your salary.

Going Bankrupt as a Self-Employed Individual: The Possibilities

You can go bankrupt as a self-employed individual in Arizona but you probably worry about the consequences for your business.

A self-employed or a sole ownership business can continue operating even in the case of bankruptcy. There are no requirements for giving up or transferring the business to somebody else.

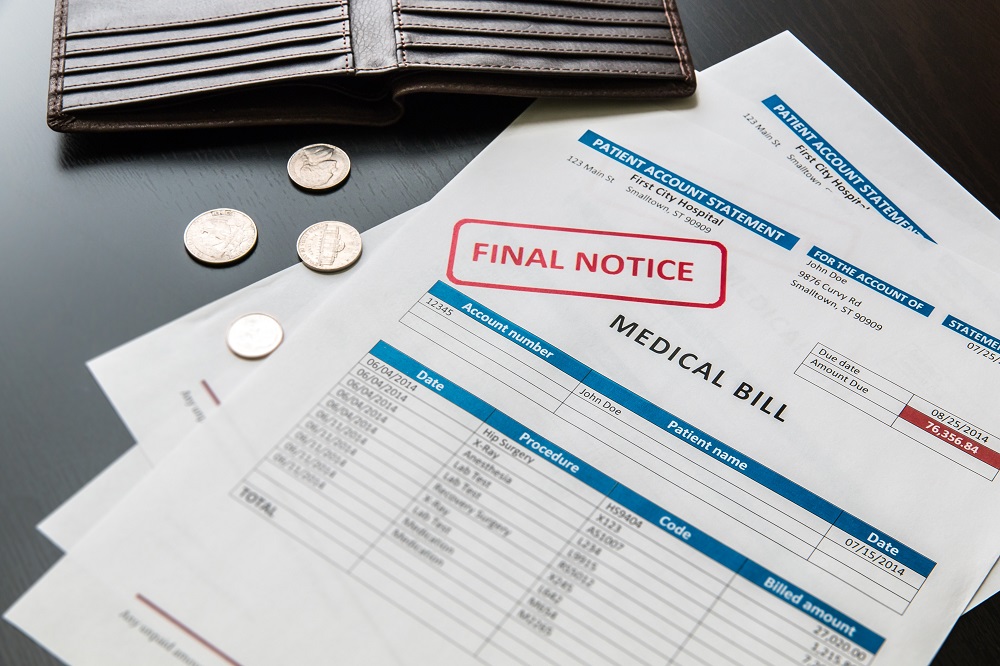

All unsecured debt that is in your name will become a part of the bankruptcy estate. This rule applies to business loans you’ve taken, credit card and even money that is owed to suppliers and sub-contractors.

Your business could be affected in a few ways as a result of the filing. For a start, property, assets and tools that do not fall under an Arizona bankruptcy exemption will have to be liquidated for the purpose of paying off some of your debt. A car that you own is subjected to an exemption, for example. If you have an additional vehicle that you use periodically to do your job, however, this vehicle may have to be given up.

Credit facilities that were previously made available could be withdrawn after you complete the bankruptcy filing. This will call for a business restructuring and the adoption of a new model aimed at ensuring financial stability. You will need to think about this effect the most, especially if you’re adamant on continuing the business activities in the future.

If you go bankrupt, a personal bank account and a separate account related to your self-employed business activity may be affected. A bank or another financial institution may have specific policies for clients who have gone through bankruptcy. Investigate such a possible impact before moving ahead with the filing.