Bankruptcy Tips and Tricks for Single Moms in Arizona

As a single parent, you carry all of the responsibility for members of the household. A single mom could also be the only person in the family generating some income. Because of these circumstances, it’s not uncommon for single moms in Arizona to consider a divorce filing.

As a single parent, you carry all of the responsibility for members of the household. A single mom could also be the only person in the family generating some income. Because of these circumstances, it’s not uncommon for single moms in Arizona to consider a divorce filing.

Is bankruptcy the right choice for you? The answer to this question depends on several factors.

Ask Yourself a Few Important Questions

Getting the answer to several key questions will help you pinpoint the best way out of debt. Before considering a bankruptcy filing, try to answer the following:

- Do you pass the Arizona means test? In order to qualify for a Chapter 7 bankruptcy filing, you will need to have an income that falls below the state median.

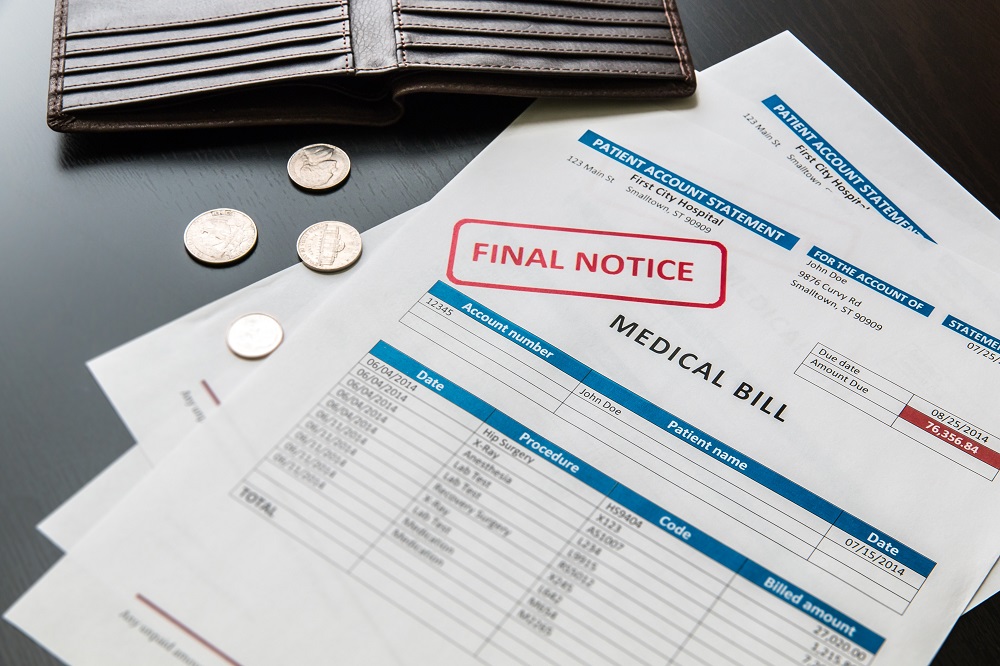

- How much debt have you accumulated and do you find yourself constantly dealing with creditors or debt collectors?

- Do you have a credit card(s) and how often do you use it? Are you falling behind on credit card payments?

- Do you know exactly how much debt you’ve accumulated?

- Have you tried to negotiate with creditors or are you considering debt settlement?

If you don’t understand some of the questions or you don’t have an answer, talking to an Arizona bankruptcy attorney will shed some light on the situation. The lawyer will clarify and help you paint a complete picture of your financial situation.

What Do You Have to Lose?

A major concern people have before doing the bankruptcy filing is that they’ll lose assets and property to get the discharge.

Arizona, just like every other state, has bankruptcy exemptions. These are the properties and assets that will not be liquidated in a Chapter 7 filing (a house, your car, pension funds, bank account funds, valuables, collections, etc.).

It is up to you to determine whether you can let go of the non-exempt assets and funds in order to get a discharge. The situation will vary from one household to another and this is why you shouldn’t rely on advice from people you know. Your lawyer will examine your assets, let you know what exemptions you’re entitled to and give you a comprehensive idea about what you have to lose and what you have to gain from the bankruptcy.

What Kinds of Debt Do You Have?

The type of debt is also important to determine whether bankruptcy is right for you.

There are major differences between unsecured and secured debt. Secured debt is tied to a collateral like your house, for example. While such debt may be discharged in a bankruptcy, a creditor will still have the chance to take the collateral.

Unsecured debt, as the name suggests, does not come with a collateral. Personal loans, medical bills and credit card debt are classified as unsecured. Unsecured debt can be wiped out in a bankruptcy.

Liquidation Bankruptcy Isn’t the Only Option

Any single parent that earns enough but that still struggles with debt should consider alternatives to Chapter 7 bankruptcy filings. A Chapter 13 bankruptcy is one such option.

Chapter 13 bankruptcy does not lead to a debt discharge. Instead, a payment plan will be determined on the basis of income. You will not lose assets but you’ll have to agree to a repayment schedule. Payments will be provided to creditors for a period ranging from three to five years. Upon the end of the plan, the remaining debt will be discharged.

The Chapter 13 bankruptcy could be a good choice because it will put an immediate end to collection efforts and it will give you a chance to breathe. While the bankruptcy trustee makes the repayment calculations, you will be provided with an opportunity to get back on your feet and put your finances in order.

Click here to find out the challenges to an Arizona bankruptcy filing.