Death during Bankruptcy Proceedings: Main Considerations

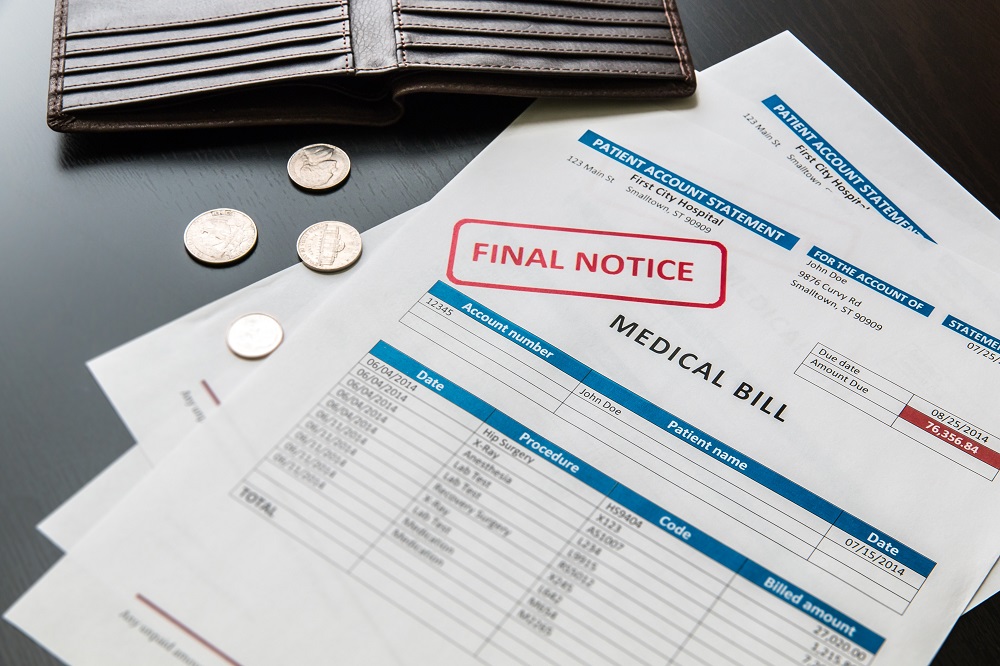

Sometimes, life puts us in unpredictable situations. Struggling with financial difficulties is obviously overwhelming. Many people will opt for bankruptcy discharge in such situations. What happens, however, on a debtor’s death during bankruptcy? Not only is this situation emotionally stressful, it will also lead to serious confusion.

If you are going through this process following the death of a loved one, you should know that Arizona has certain provisions in place to streamline the bankruptcy proceedings. The first thing you may want to do is see an experienced bankruptcy attorney to get a better idea about the law and the options ahead of you.

What happens to the Bankruptcy Case?

There are two possible scenarios following debtor death and they depend on the type of bankruptcy filing.

In Arizona, a Chapter 7 bankruptcy will more or less be unaffected by debtor death. This is a liquidation process. The trustee is responsible for handling non-exempt income and assets for the purpose of paying out to creditors. The remaining debt following the completion of the liquidation will be discharged.

Once initiated, the process will go on even in the case of death. The trustee will continue the administration of the process until a discharge is reached.

Chapter 13 bankruptcies are different because there’s no liquidation. Rather, a payment plan is determined and the plan remains valid for a period of three to five years. Obviously, the debtor is actively involved in the process because they are responsible for making payments to creditors.

Following the death of a debtor, heirs may find it difficult to keep on producing the monthly payments. In such a situation, the case will get dismissed. The survivors will need to petition court following the debt. Based on the specifics of the situation, several outcomes are possible:

- Case dismissal: the most common option in which survivors don’t undertake the necessary actions and the Chapter 13 case is dismissed.

- Continuation of the Chapter 13 bankruptcy: it may be possible for the bankruptcy case to continue as if the death hasn’t happened. The court will make the decision whenever it’s in the best interest of successors.

- A conversion to Chapter 7 bankruptcy: successors who are struggling financially may ask the Chapter 13 to be converted into Chapter 7 bankruptcy. This court decision isn’t a particularly common one.

- Hardship discharge: whenever successors are struggling financially, they may also request a hardship discharge from the court. Whenever the discharge is granted, all qualifying debt is cancelled before the end of the Chapter 13 period. Creditors do not have the right to come after successors and demand a payment.

The Status of Debt and Heirs

Many people worry what would happen in the case of their eventual death, especially if significant amounts of debt have been accumulated. The main concern is that the debt will pass down to heirs who will be responsible for handling the situation.

Usually, this isn’t the case. Debt is passed down only when a person has a joined loan with one of their children or heirs. Still, creditors could look into the property and the assets that you leave behind.

Usually, this isn’t the case. Debt is passed down only when a person has a joined loan with one of their children or heirs. Still, creditors could look into the property and the assets that you leave behind.

In a Chapter 7 bankruptcy, heirs usually get to keep all of the exempt property and assets that the debtor leaves behind. These are the assets, belongings and real estate the trustee cannot use for the purpose of liquidation.

Another thing you need to think about is a life insurance. If there’s such a policy, the trustee may eventually take it. Such a scenario of the insured debtor’s death during bankruptcy, will leave the family with nothing.

If you are in poor health and you’re concerned about your ability to finalize the bankruptcy proceedings, see an attorney immediately. If you’re the heir of a debtor who has passed away in the middle of a bankruptcy case, the same will apply to you.